41 Professional Cancellation Letters (Gym, Insurance, Contract + MORE)

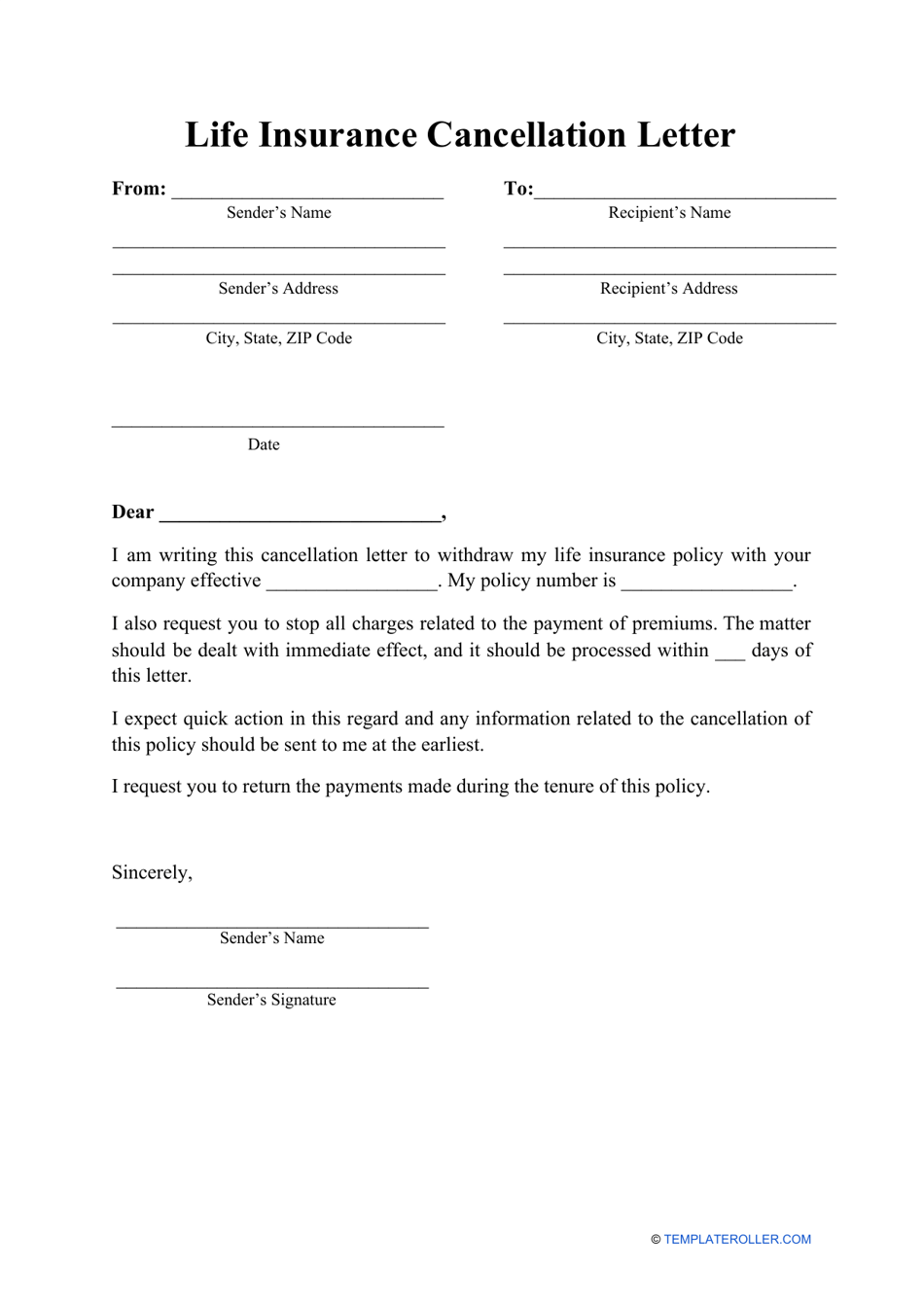

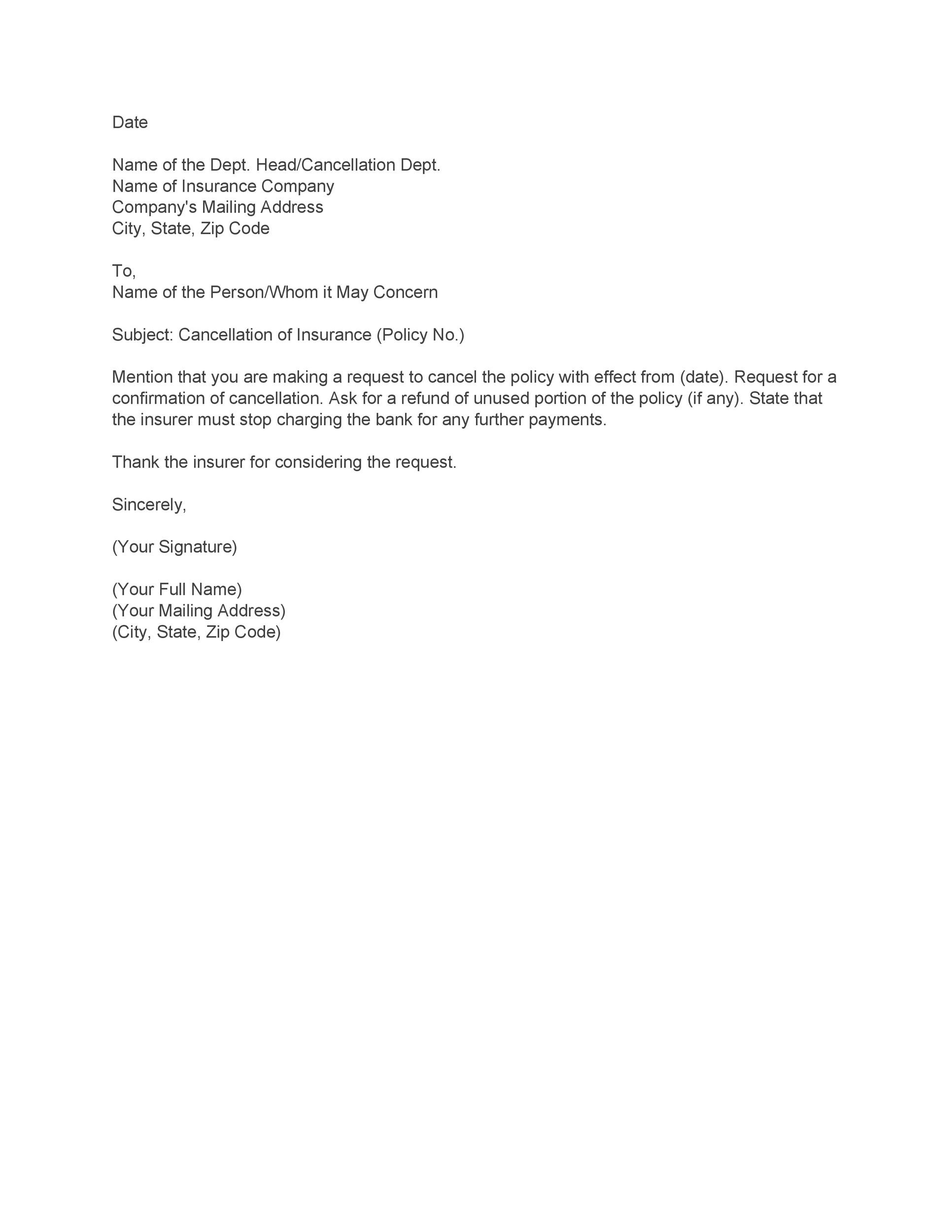

The letter requesting cancellation of an insurance policy must have the following parts: 1. Heading: The heading should include your policy number, name, and address, as well as the name and address of the insurance company. This information should be placed at the top of the letter and should be clearly visible so that the insurance company.

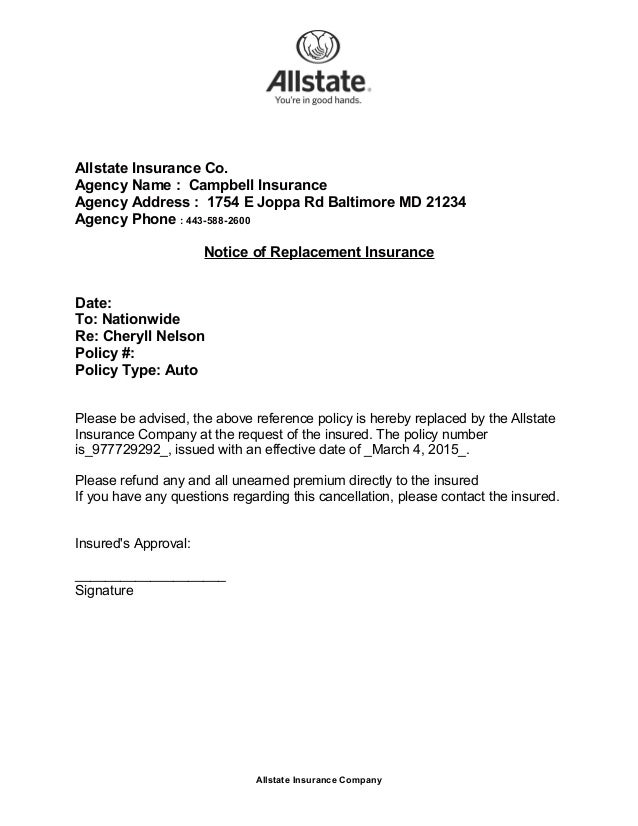

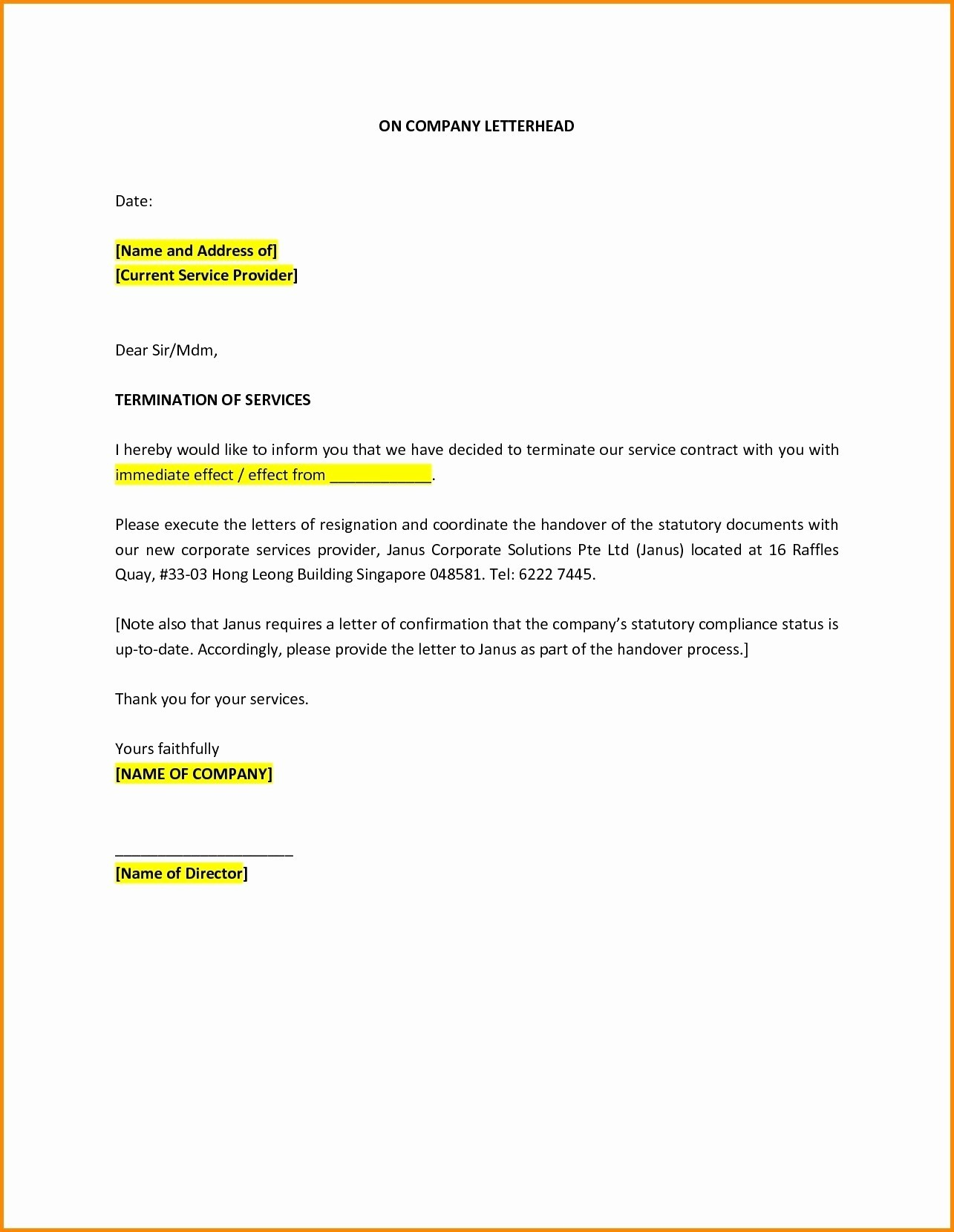

Nelson cancellation letter

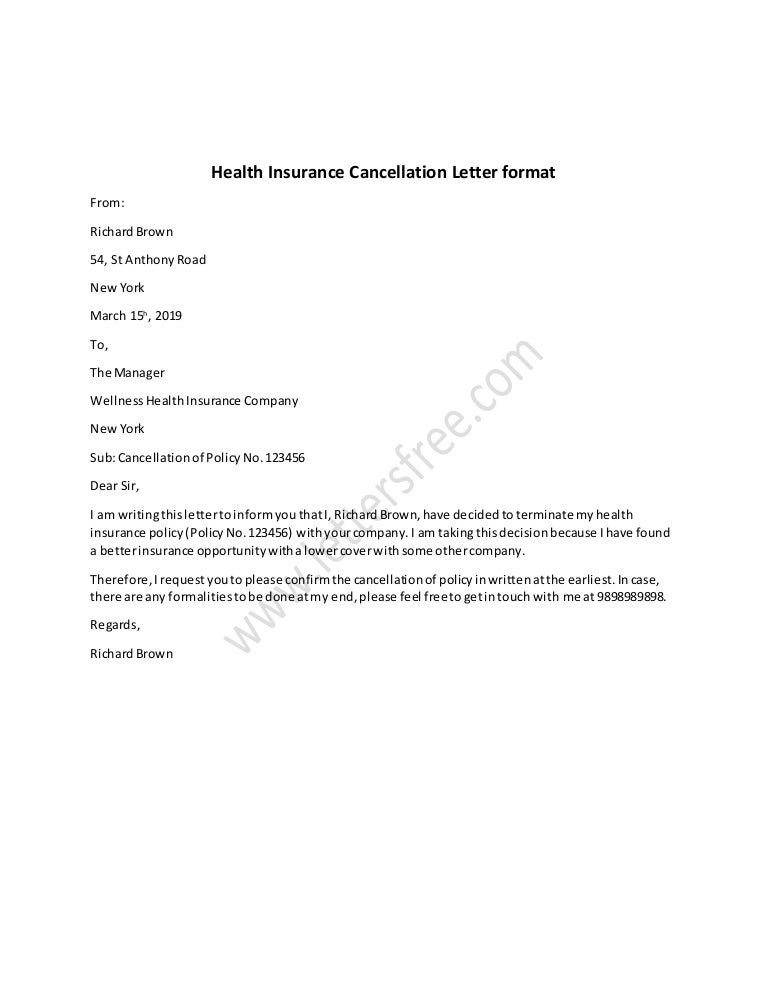

An Insurance Cancellation Letter is a formal document sent by a policyholder to their insurance company, requesting the termination of an insurance policy. It typically includes essential details such as the policy number, type of insurance, effective date of cancellation, and the policyholder's contact information..

41 Professional Cancellation Letters (Gym, Insurance, Contract + MORE)

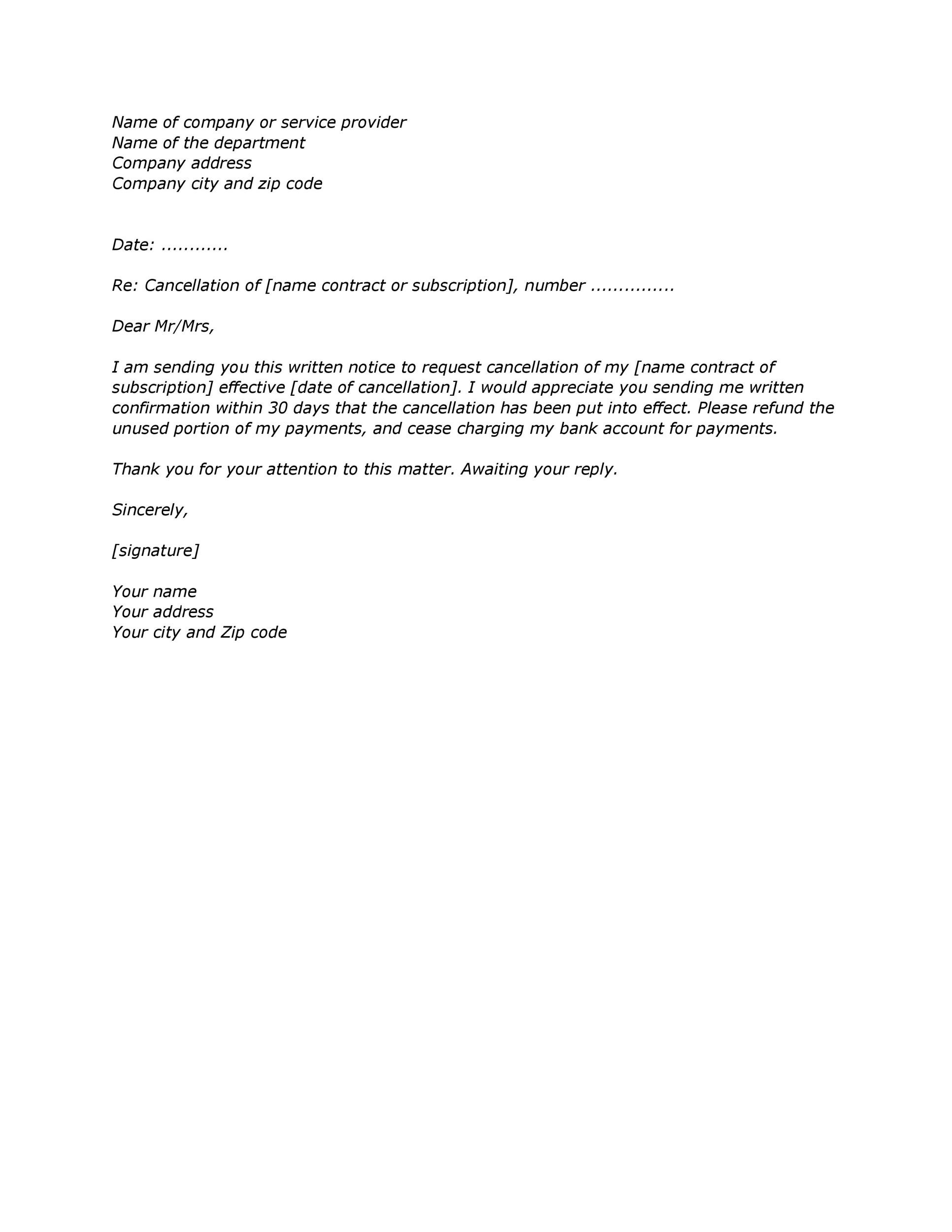

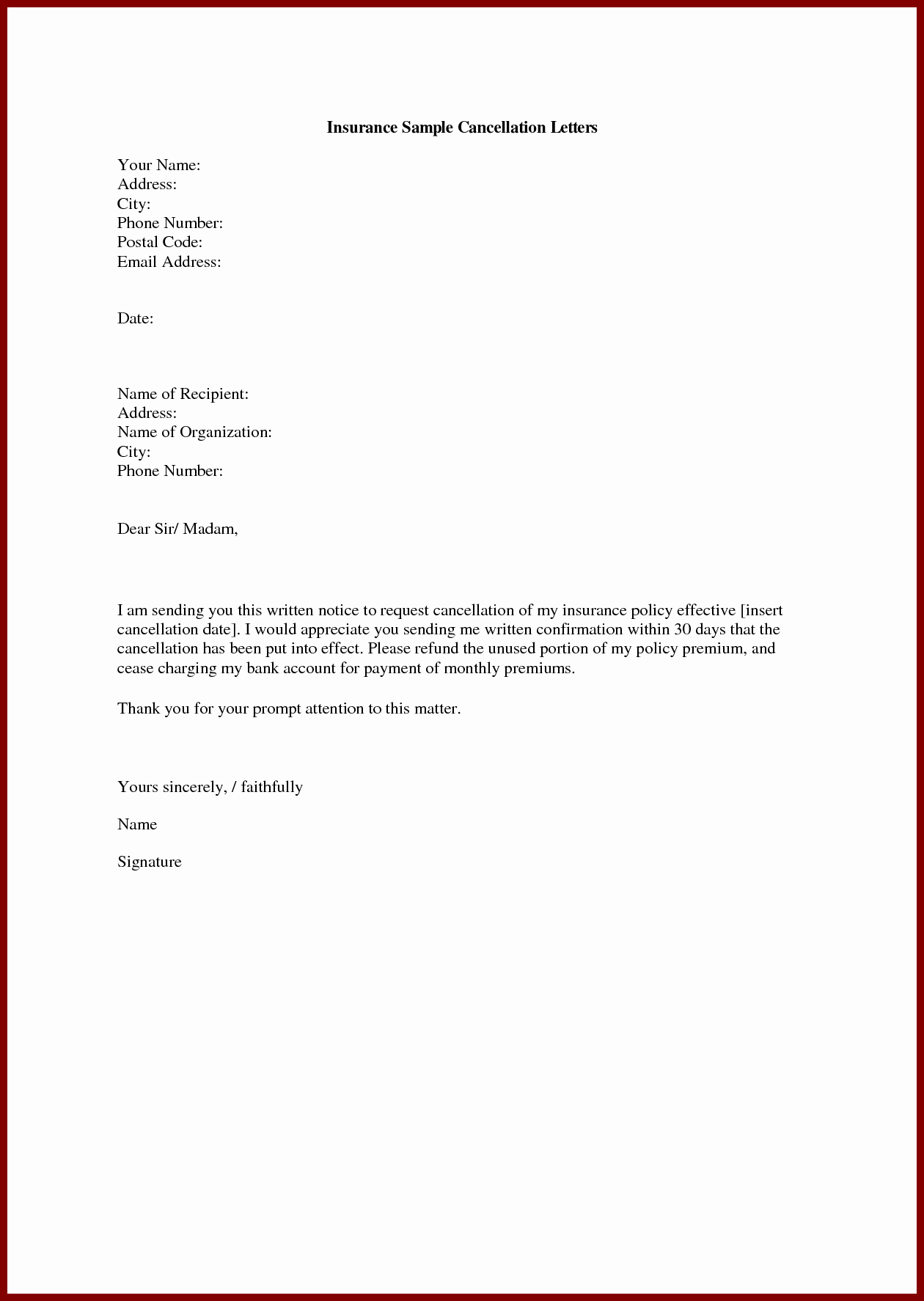

Note on our sample insurance cancellation letter template, we include the language for certified mail, with a return receipt requested. Done through the post office, a return receipt is considered proof of delivery and should be saved in your records along with your written confirmation letter. Checklist for Insurance Cancellation Letter

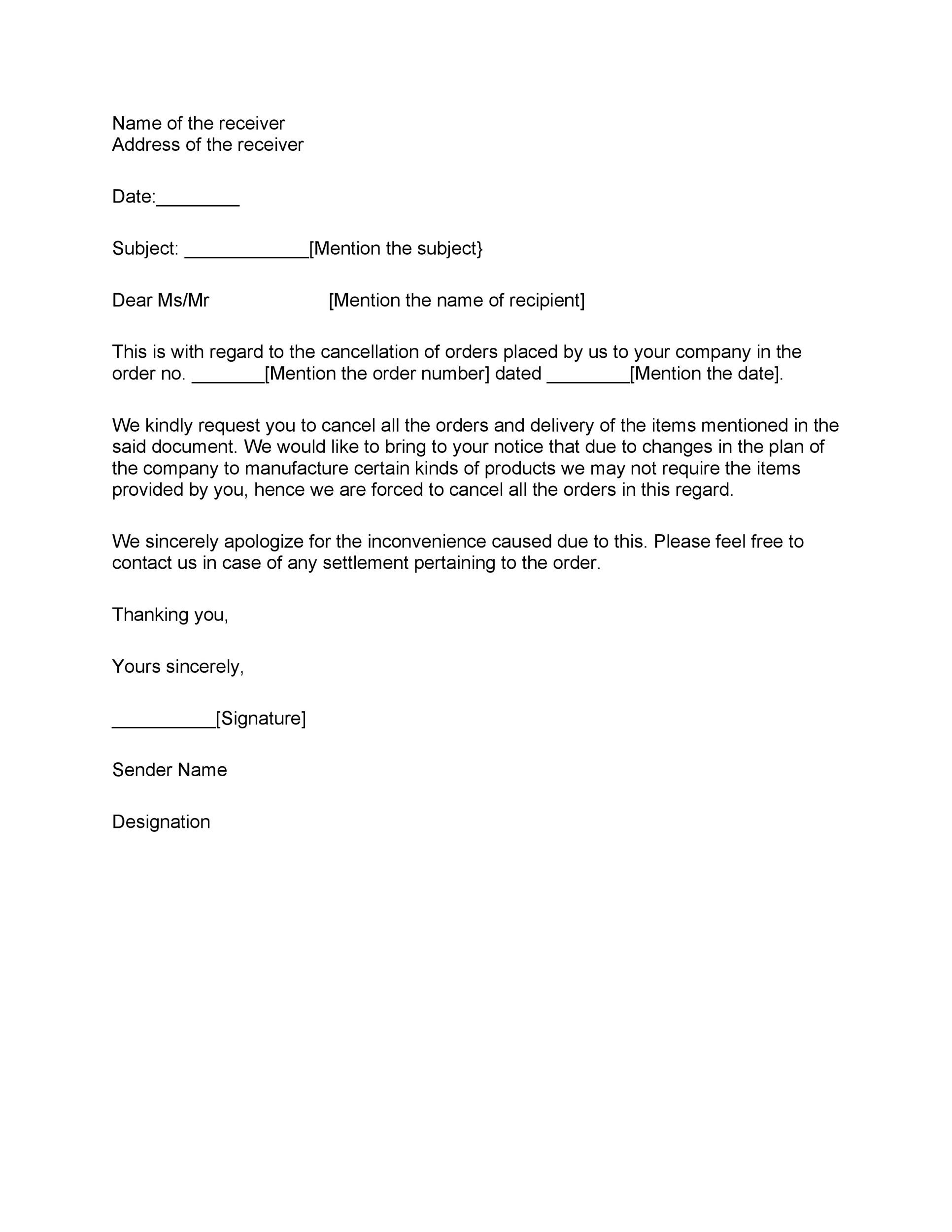

How To Write A Cancellation Letter For Home Insurance at All_8

Sample Insurance Cancellation Letter. Cancelling an insurance policy must be done in writing since policies are contracts. In order to withdraw from the contract you will have to send a letter giving your insurer written notice of cancellation. Putting your request to cancel in writing also safeguards your interests, providing hard copy proof.

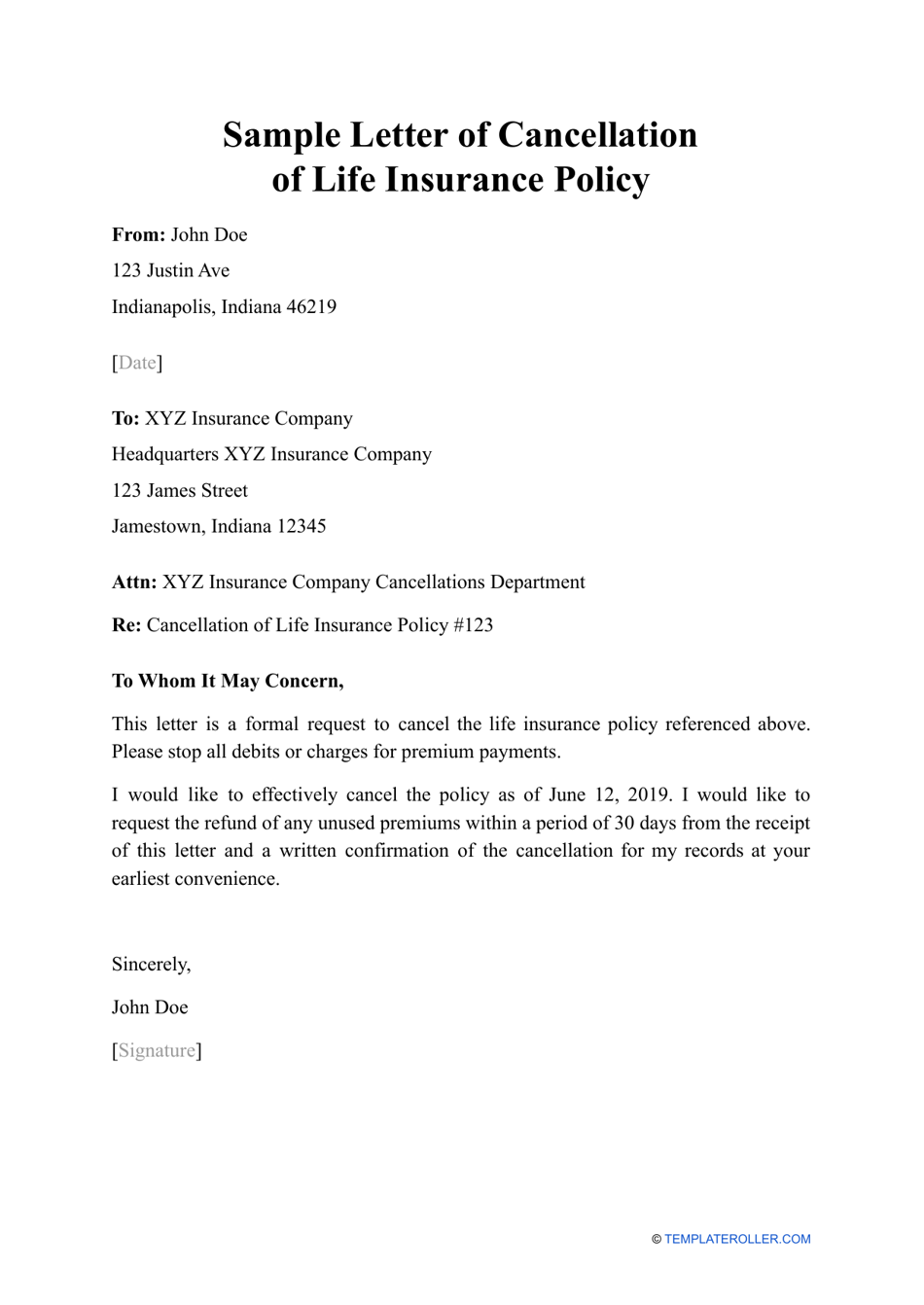

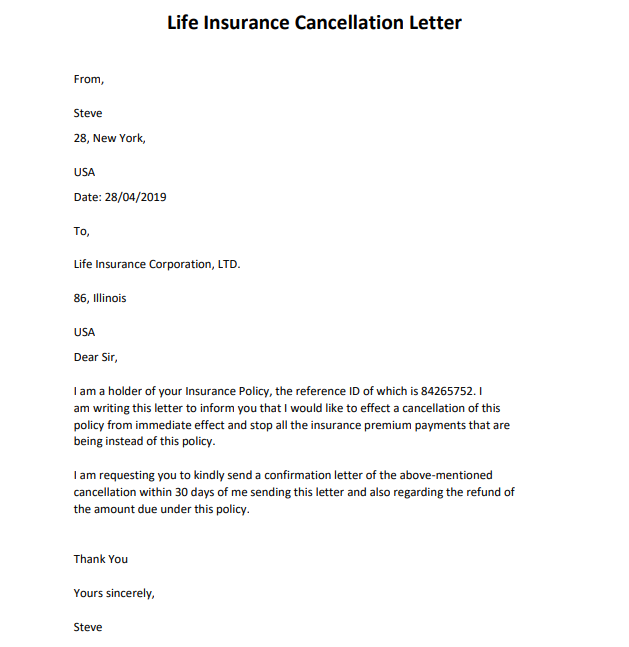

Sample Letter of Cancellation of Life Insurance Policy Download

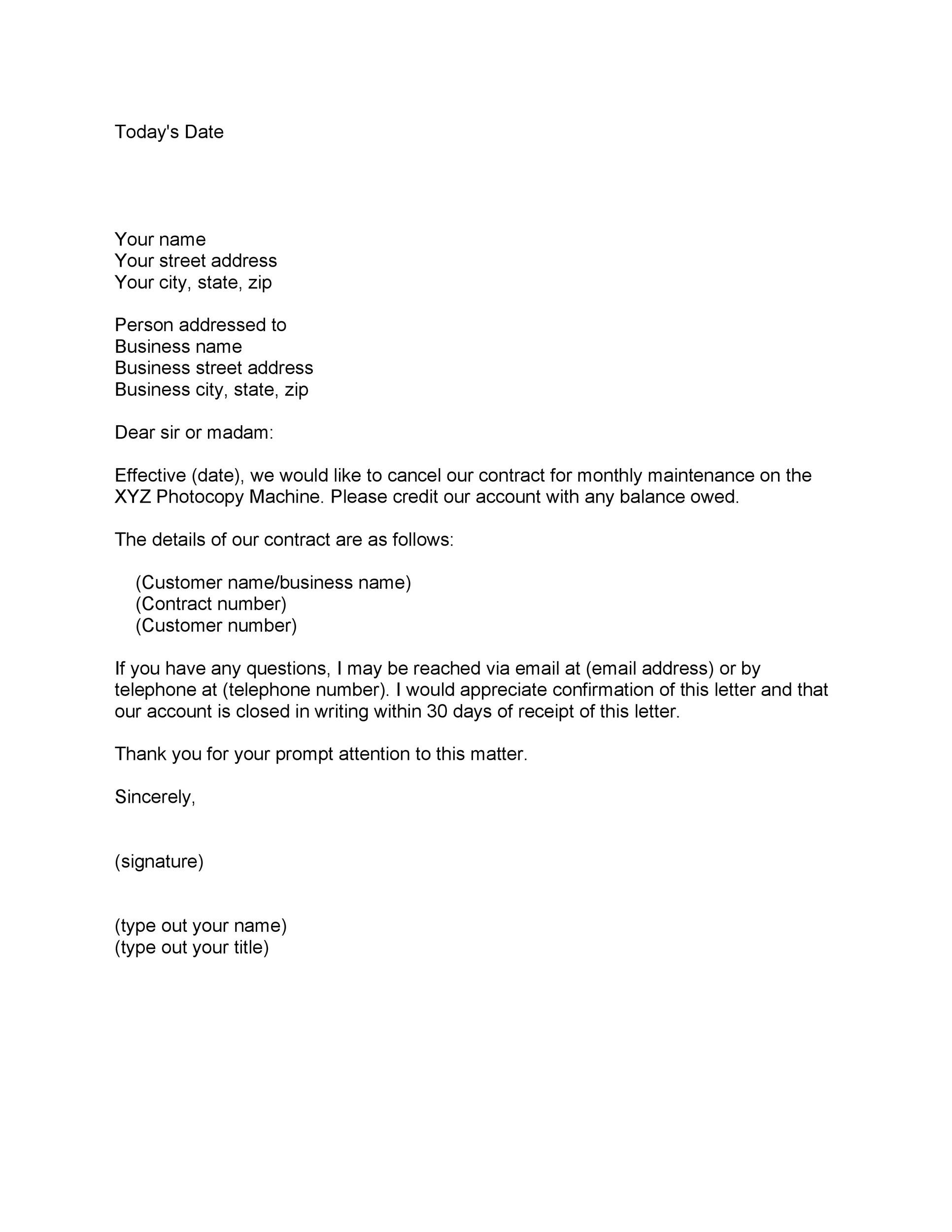

A written cancellation letter is a reliable way to convey your decision to the insurance company. This letter should include: Your name, address, and contact information. The date of the letter. The insurance company's name and address. Your policy number and the type of insurance. A clear statement of your intent to cancel.

Life Insurance Cancellation Letter Template Download Printable PDF

Policy number : Double check to ensure your it is correct on the letter. Your address and contact information : This can be used to follow up with you. Company name : Name the insurance company, not your advisor. The current date : The date when you are writing the letter. Cancellation date : Provide a specific date for the changes to take effect.

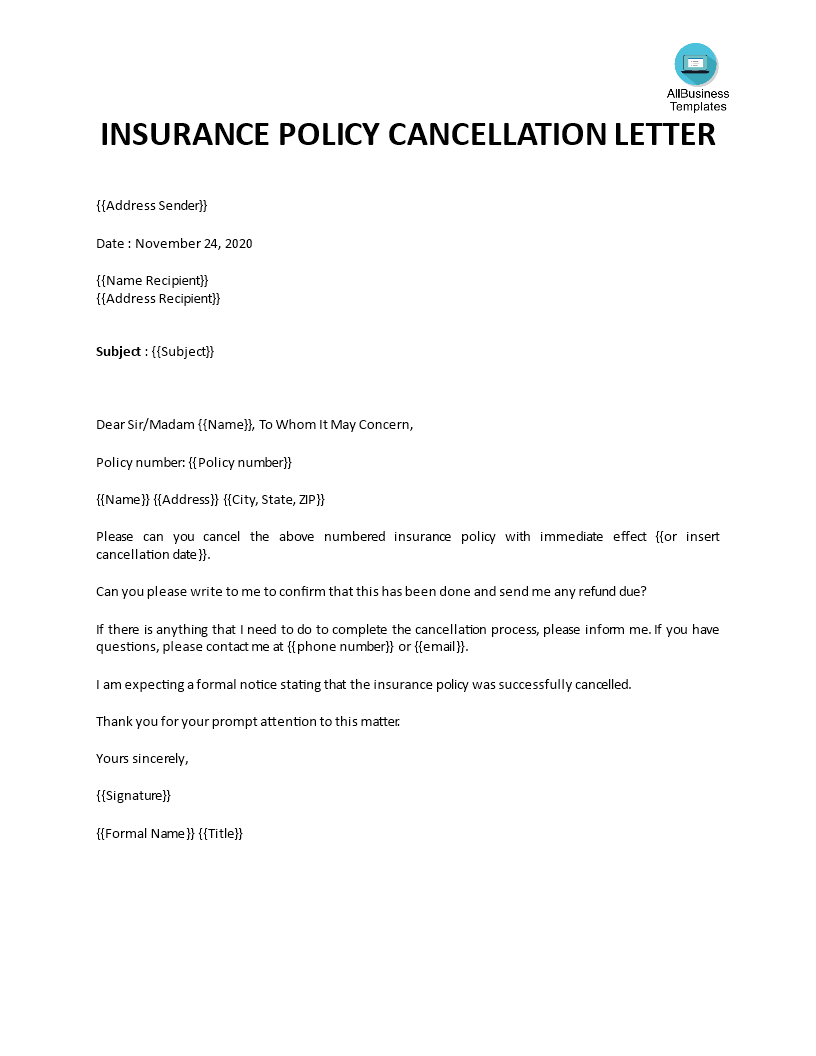

Insurance Policy Cancellation Letter 16 Cancellation Letter Templates

An insurance cancellation letter is a formal written document that is submitted to an insurance company to request the termination or cancellation of an existing insurance policy. The letter serves as a written record of the policyholder's intention to discontinue the insurance coverage and outlines important details such as the policy number.

Insurance Cancellation Letter Template Format Sample & Example

5 Steps on How To Write Best Insurance Cancellation Letter: Start with a clear and concise statement of cancellation. Include the policy details, such as the policy number, start and end dates. Explain the reason for cancellation in a polite and professional tone. Request a confirmation of the cancellation and any applicable refunds.

Insurance Cancellation Request Letter For Your Needs Letter Template

Begin your letter with a polite opening, addressing the recipient by name or title, and stating clearly what your purpose is. For example, "Dear [Name], I regret to inform you that I must cancel my home insurance policy effective immediately.". Next, you will want to provide the reason for the cancellation.

Sample Health Insurance Policy Pdf

Subject- Letter of health insurance cancellation. Please accept this letter as my formal petition for the above-mentioned policy to be cancelled. This cancellation will take effect on. Please return any unused premiums to me at the address mentioned below as soon as possible.

Insurance Cancellation Letter Template Samples Letter Template Collection

Here are some tips on how to write a letter to cancel your insurance policy: Include your full name, policy number, and date of cancellation. This ensures that the insurance company can correctly identify your policy and process your cancellation. State the reason for cancelling your policy. Whether it's due to finding a better deal elsewhere.

Powerful Insurance Cancellation Letter Samples and Format

The name of your company. Name the insurance company, not your insurance agent. The date when you wrote the letter. The effective date of cancellation. Provide the date when you want the cancellation to take effect. Your reasons for canceling your insurance subscription. A refund or stop payment request.

41 Professional Cancellation Letters (Gym, Insurance, Contract + MORE)

To ensure your insurance policy cancelation letter is taken seriously, make sure all of these are included in your letter: Your name: For your cancelation letter to be effective, the name of the account holder must be written. For a policy to be canceled, it must include the correct information of the policyholder.

Policy Cancellation Letter Insurance templatelab fee slidedocnow

Insured's name (found in the declarations page of the policy) Insured's mailing address. Insured's phone number. Policy number. Coverage period (on declarations page) Next, draft the body of the letter. The body should include: The date you would like your policy to be canceled. A request for a refund of unused premiums.

Insurance Cancellation Letter Template Samples Letter Template Collection

Here's how to write a car insurance cancellation letter: Step 1. Make sure you have your new policy all lined up. You don't want your coverage to lapse when switching car insurance companies. As little as one day without insurance is a red flag to insurers, which may raise your rates in the future because of that lapse.

41 Professional Cancellation Letters (Gym, Insurance, Contract + MORE)

The following items should be included in your insurance cancellation letter: The date of the notification. Name and address of the insurance business. Name of the appropriate department and contact person. Name of the insured (found in the declarations page of the policy) The address of the insured. The phone number of the insured.